As we go into the next decade, few themes outside of the AIs and the LLMs of the world, have been quietly emerging from abyss and becoming larger by the day. These themes, in my view are geography specific, so they need to be looked at from a pointed perspective. Today I will touch upon one of them – the luxury / premium market that caters to the top 1-4% of India. Before delving deeper into one of our portfolio companies which is an offshoot of this theme, let me set some context here

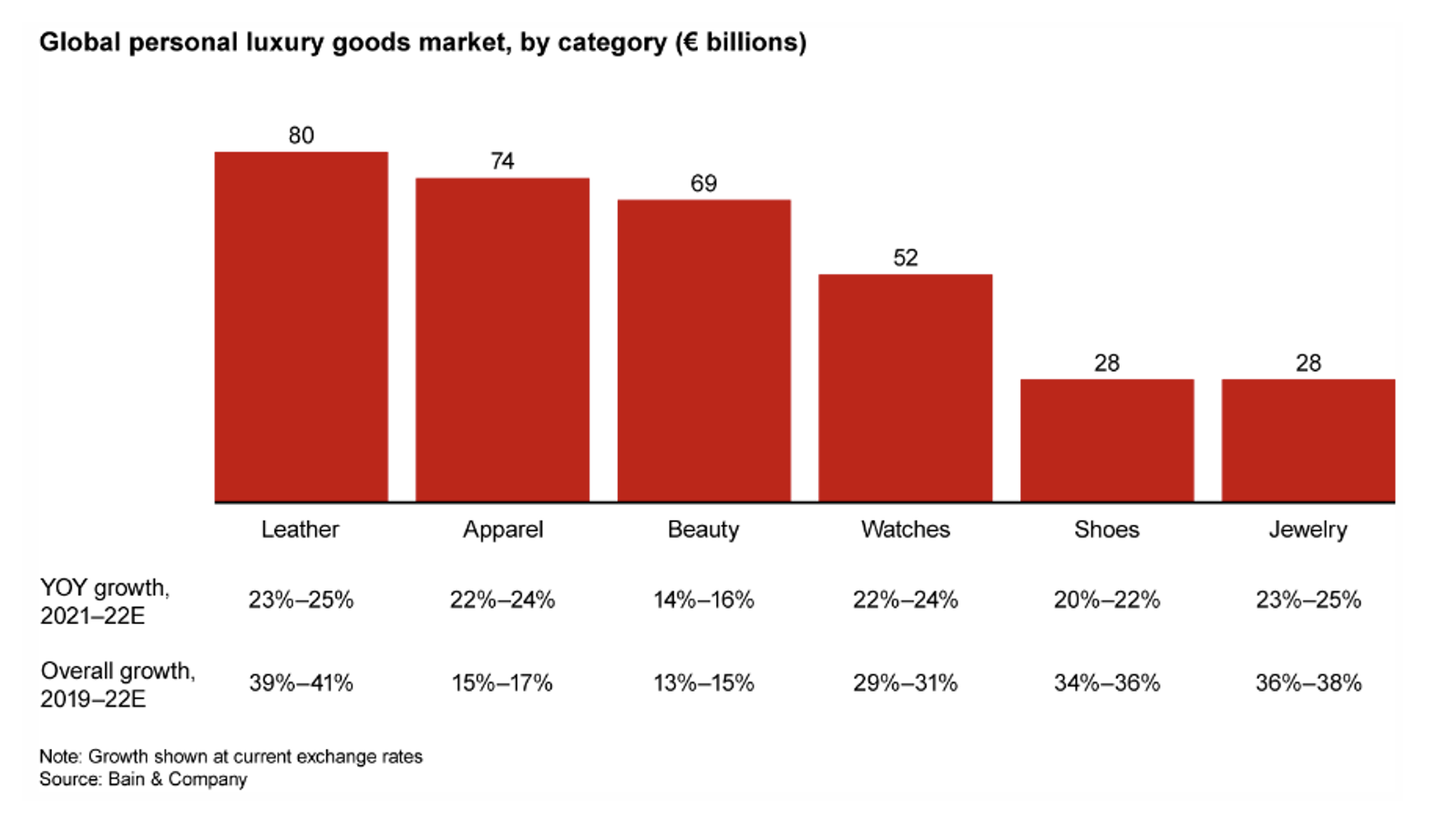

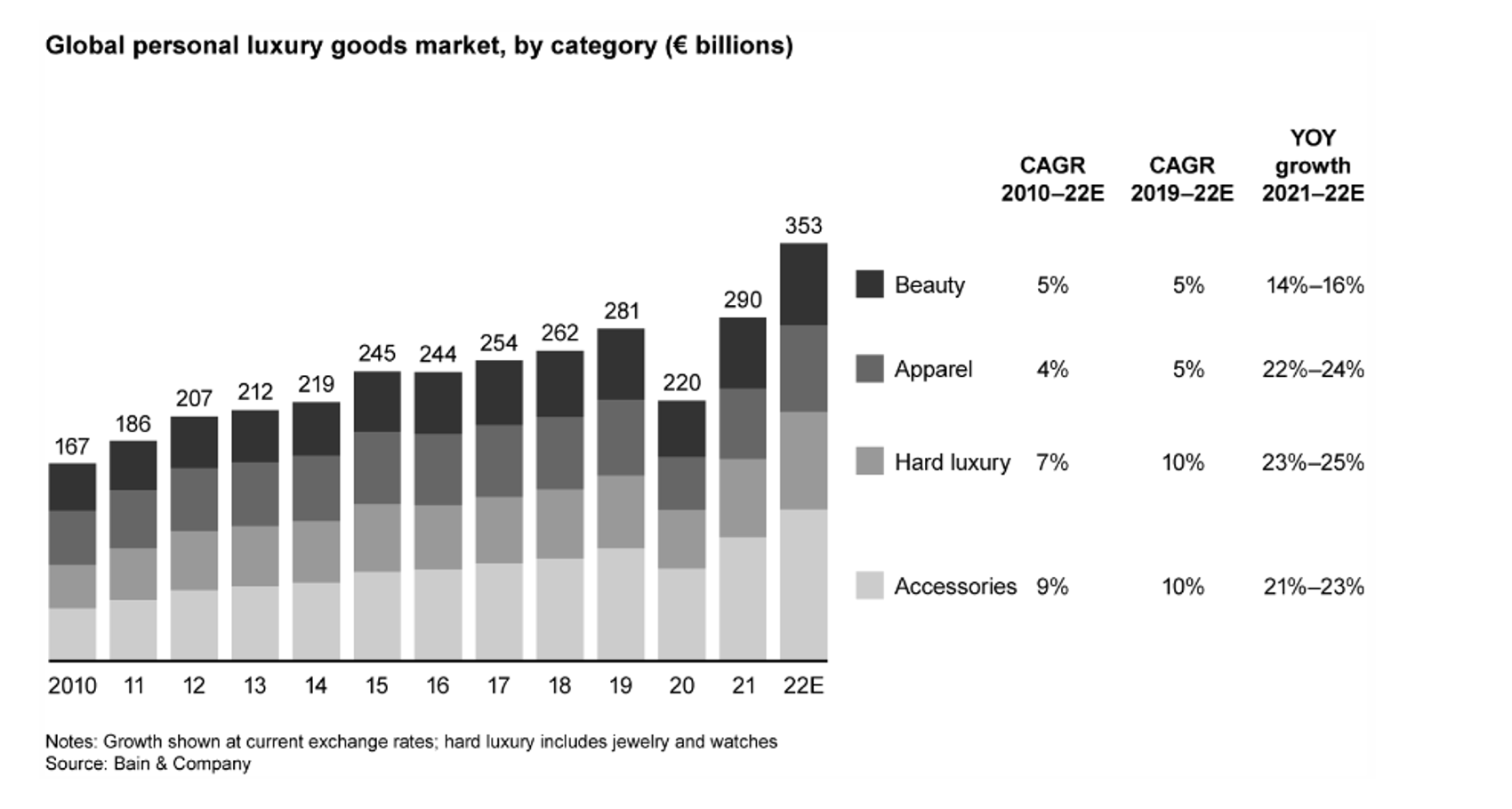

A much-needed global perspective: After a severe contraction in 2020 due to the Covid-19 pandemic, the luxury market grew to €1.15 Tn[1] in 2021 and surprised everyone in 2022 by further growing at ~20%1. Within this, personal luxury goods segment, the core of luxury market, witnessed a V-shape recovery, leading to a remarkable explosion (CY2019-22 CAGR of ~26%)1. The consumer base in this segment is unique i.e. it’s both large and more concentrated on top customers who are less sensitive to downturns.

At a macro level, few attributes stood out in the last 2 years: a) incumbents (China, EU etc) continued to lead but newcomers (India, SE Asia etc.) became the key driver for future growth, b) omni channel retail presence, c) outperformance across all categories, d) an ever-ballooning customer base and e) generational trends realigning with the market as we enter the next 10 years phase.

[1] Bain & Company Research, January 2023

Extrapolating the discussion to India, the premium consumption segment in India is turning out to be a bright spot in a challenging retail environment post covid, with brands continuously innovating to capitalize on new trends. Quite a few companies have changed their product portfolio mix in the last 2-3 years with a higher focus on premium products. Although premiumization started in 2021 and prices have stabilized since mid-2022, the increasing move towards buying premium products has kept pushing up the ASP across categories. This buying pattern is an aspirational one vis-à-vis the convenience and simplicity of feature-rich products. Although, a feature yet common in the top 8 cities, this aspirational buying, the spread of e-commerce and digital payments, and social media whetting consumer appetite, have now taken demand for premium products to small towns as well.

Just to give you a flavour of the level of premiumisation in the country – top ~4%[2] of the working age population in India or the Affluent India has a per capita income >~US$10,000 p.a.2, compared to India’s average per capita income of ~US$2,1002. This ‘Affluent India’ comprised ~44mm of the working age population in 2023, which is expected to reach ~100 mm2 of the total population by 2027. Top end consumption is growing much faster than broad based consumption.

[2] Goldman Sachs Research, January 2024

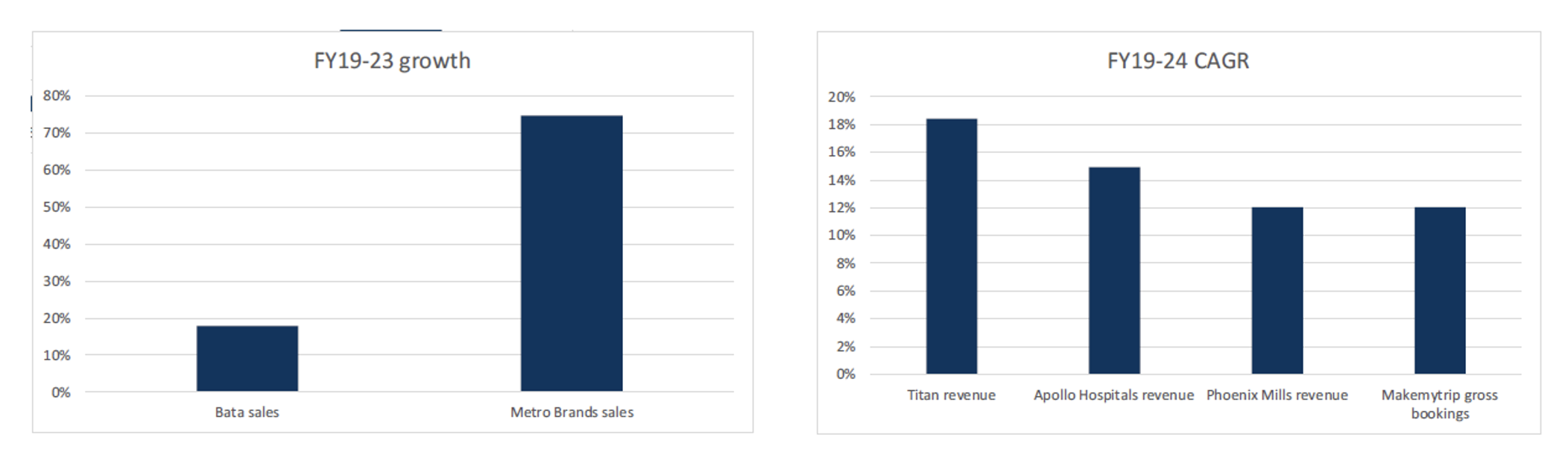

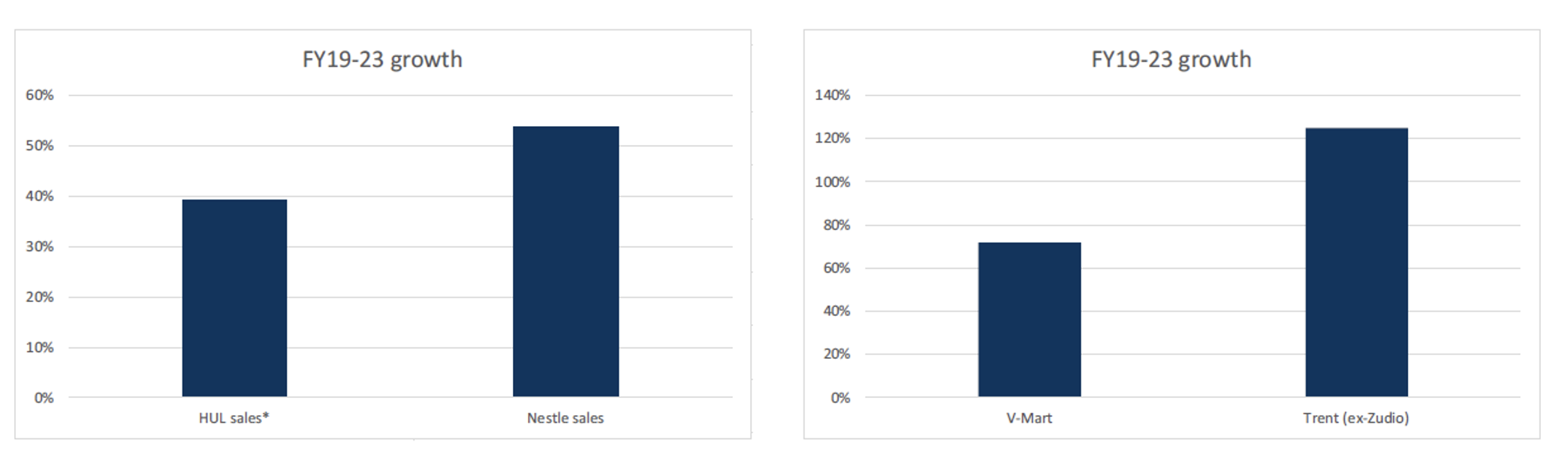

Public markets are a clear indicator of the direction in which this momentum is building. The trends[3] discussed above are clearly visible in listed companies across FMCG (Nestle India growing faster than HUL), footwear (Metro growing faster than Bata), fashion (Trent growing faster than V-Mart), passenger vehicles (SUVs growing faster than entry level cars) and 2-wheelers (Eicher growing faster than the industry). Also, companies exclusively addressing the top income consumers are growing rapidly.

Additionally, if you look at the credit card spends, the same has increased 2.5x in the last 12 months against FY19. Also, category wise per capita expenditure of India’s top 10% is significantly higher as compared to Rest of India

Riding along this wave of premiumisation in the country is a sub-category, luxury fashion. This segment in India is expected to grow 4-5x its current size to reach ~$200 Bn by 2030. This growth is fuelled by the rise of both homegrown luxury fashion brands such as Sabyasachi, Manish Malhotra, Tarun Tahiliani, and Anamika Khanna and western luxury brands such as Louis Vuitton, Dior, Balenciaga, Balmain, Chanel etc. Currently ~1.7 Mn people in India are forecast to hold more than a million dollars’ net worth by 2027, making it an attractive destination for high-end labels. To lay out a comparison, while advanced economies such as US and EU remain stagnant and while recession looms over the former, the latter is a very mature market and has an ageing population. China — another important market for luxury — also continues to face macroeconomic headwinds before it takes off again. Hence, from a 10-year horizon, quite a few tailwinds support India’s growth story in the luxury segment.

[3] Goldman Sachs Research, January 2024

* HUL organic sales growth (ex-Nutrition)

Playing out this thesis within our fund, SNV invested in a company called Mainstreet Marketplace (MNST). It started off as a reseller of super premium sneakers, focussing on India as its market. Vedant Lamba, the founder is himself a well-known social media content creator and understands the pulse of luxury focussed consumers in India. Vedant found a gap to fill in the market for super premium sneakers. This led to creation of a marketplace to resell high end branded sneakers.

On the supply side, it’s a highly unorganized market of sellers, which comprises of school and college kids who have an innate craze for these sneakers i.e. before a serious drop is announced, these sneakerheads would line up outside of the stores the previous night to get hold of the limited-edition shoes and will sell it forward at a mark up to the likes of Vedant. Vedant was quick to realize the top of the funnel customers that he created using his social media channels and took this opportunity to merge this demand and the supply through a marketplace. Similar stories have played out globally with the likes of StockX & GOAT that are currently multibillion-dollar businesses. However, the trend is just starting to pick up in India. When we invested in MNST, per our estimate, TAM for reselling sneakers stood somewhere b/w ~$100-150 Mn and is evolving as we speak, which in our belief is already ~3x of the previous year estimates. Broadly a few things stood out for us when it came to MNST:-

- The drive and passion of Vedant – He knows his organic funnel and his consumer’s behaviour quite well. He has a strong focus on building a brand that resonates with the top ~1-4% of consumers in India and he does not shy away from being a true venture and take a risk or two 😊

- Focus on hybrid selling – Online + offline (stores in Delhi and Mumbai)

- Category creation – one of the first ones to step into this market with a good headroom

- An expanding market allows the flexibility to experiment

- Ability to venture into other categories

- Exclusivity – the company tries to curate as much limited supply of sneakers from the sellers as possible

- Personalized experience

- Strong brand positioning – more of a pull than a push